What fields are in an estimate and how are they calculated?

Background

Answer

Data in an estimate typically flows left to right, and then into the summary section.

There are two different ways that you can show labor in an estimate.

- Individual Labor Rate - When using labor rates, you set the labor rate as the cost per hour/minute, and then indicate how many minutes or hours are needed. You can also include a 'difficulty' multiplier that indicates how many people are needed to perform the work.

- Unit Cost Pricing for Labor - When using unit cost pricing for labor, labor is set at a flat rate. It calculates labor as Quantity x Labor Cost.

Based on your settings, you will see different fields in the estimate.

Tip

The default setting for how you show labor is configured in your tool's settings:

- Bid Board and Portfolio Planning tool - Configure Bid Board Settings

- Estimating tool - Configure Default Estimating Settings

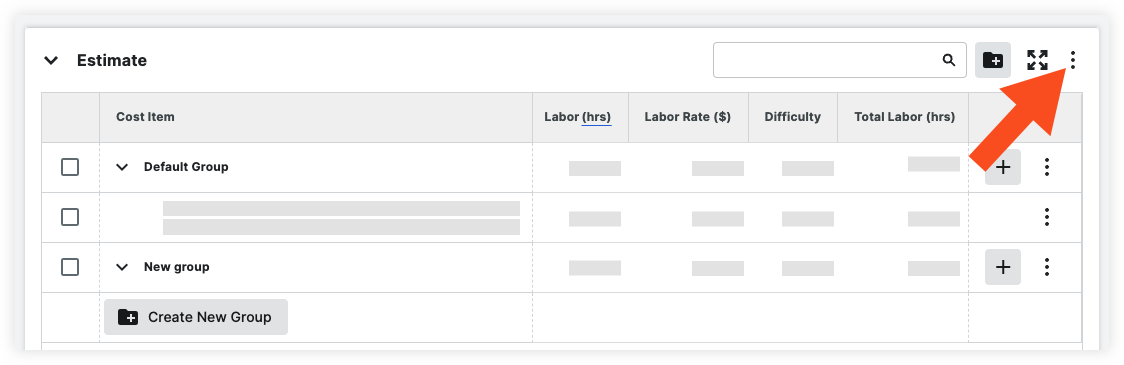

You can also update the settings for a specific project by clicking vertical ellipsis ![]() for the estimate, and turning the "Use 'Unit Cost' pricing for labor" toggle

for the estimate, and turning the "Use 'Unit Cost' pricing for labor" toggle ![]() ON or

ON or ![]() OFF.

OFF.

Labor Rate

Show/Hide Field Descriptions and Calculations

Estimate Section

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Budget Code | Source | Yes |

A budget code combination of cost code, cost type, sub job, and custom segments, that creates corresponding line items in your budget. Default settings for an item or assembly are configured in your Cost Catalog. |

| Quantity | Source | Yes |

The quantity of the item as calculated in the takeoff. The default quantity is equal to 2D takeoff quantity + 3D takeoff quantity. |

| Unit Cost ($) | Source | Yes |

The cost of a single item. Default cost settings for the item are configured in your Cost Catalog. |

| Waste (%) | Source | Yes |

A percentage of material over the actual estimated quantity. The default setting is set in the 'Summary' section of the estimate of the estimate, under 'Lost Time & Waste'. |

| Subtotal Item Cost ($) | Calculated | Yes* |

The subtotal cost of an item's materials, equipment, or other, as determined by the cost item type in the Cost Catalog. Subtotal item cost is equal to Quantity x (1+ Waste %) x Item Cost. *Total cost can be overridden on Group level. |

| Margin/Markup (%) | Source | Yes |

Your profit margin for the item cost, as a percent for the item. Margin is based on the sales price. Markup is calculated based on the cost of the item. The default setting for Material, Equipment, Subcontractor, Travel is set in the 'Summary' section of the estimate. |

| Sales Price ($) | Calculated | No |

Sales price is equal to: Total Cost x ( 1 + Markup) |

| Subtotal Item Sales ($) | Calculated | No | Subtotal Item Sales is equal to Sales Price x Quantity. |

| Profit ($) | Calculated | No | Profit is equal to Total Sales - Total Cost. |

| Unit Labor (mins, hrs) | Source | Yes |

Labor time needed for a single item. The default labor settings for an item or assembly are configured in your Cost Catalog. |

| Labor Rate | Source | Yes |

How much one (1) hour of labor costs. The default rate is set in the 'Summary' section of the Estimate. |

| Difficulty | Source | Yes |

The difficulty factor to account for job complexity. The default difficulty is set in the 'Summary' section of the Estimate. |

| Total Labor (hrs) | Calculated | No |

Total Labor is equal to Quantity x Labor (hrs) x Difficulty. |

| Total Labor Cost ($) | Calculated | No |

Total Labor Cost is equal to Total Labor x Labor Rate. |

| Labor Margin/Markup (%) | Source | Yes |

Your profit margin/markup for labor. Margin is based on the sales price. Markup is calculated based on the cost of the labor. The default is set in the 'Summary' section of the Estimate. |

| Total Labor Sales ($) | Calculated | No |

Total Labor Sales is equal to: Total Labor Cost x ( 1 + Labor Markup) |

| Total Cost ($) | Calculated | No |

Total Cost ($) is equal to: Subtotal Item Cost + Total Labor Cost ($) |

| Total Cost / sq ft | Calculated | No |

Total Cost / sq ft is equal to: Total Cost ($) + Project Square Feet (This number is entered in the project Admin tool - Project Information) |

| Total Cost (%) | Calculated | No |

Total Cost (%) is equal to: A percentage of Total Cost ($) over the Total Sales ($). |

| Total Sales ($) | Calculated | No |

Total Sales ($) is equal to: Subtotal Item Sales ($) + Total Labor Sales ($) |

| Notes | Standard | Yes | Notes may be typed into this column for each item. Notes are NOT private and will be visible to other users with permissions to view the estimate. |

| Tax | Source | Yes |

Turn on or off material tax for individual items. All other items are considered taxable. Default settings for an item or assembly are configured in your Cost Catalog. |

Summary Section

Global Rates

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Global Labor Cost | Standard | Yes |

The default cost of labor per hour. When set, this updates the 'Labor Rate' column for all rows in the estimate with the Labor item cost type. |

| Global Labor Sales Rate | Calculated | No | This is equal to Global Labor Cost + Labor Margin/Markup that is set in the 'Summary' section. |

Labor and Materials

Note

The following are available for each Cost Item type (material, labor, equipment, subcontractor, and travel), defined in your Cost Catalog. See How do Cost Catalog item types relate to cost types in Procore?

These do NOT currently reflect cost types incorporated into budget codes or your work breakdown structure.

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Total Labor | Calculated | No | Total Labor is equal to the sum of Labor Hours for all rows in the estimate with the Labor item cost type. |

| Difficulty | Standard | Yes |

The difficulty facto to account for job complexity. When set, this updates the 'Difficulty' for all rows in the estimate with the Labor item cost type. |

| Lost Time & Waste % | Standard | Yes |

The default percentage per cost type, based on the item type from the Cost Catalog. When set, this updates the percentage Lost Time & Waste for all rows in the estimate with that cost type. |

| Total Cost ($) | Calculated | No |

For Labor, this is equal to Quantity x Difficulty x Labor Rate, for all rows in the estimate with the labor item cost type. For all other cost types, Total Cost is equal to the sum of Cost x Quantity for all rows in the estimate for that cost type. |

| Profit Markup/Margin % | Standard | Yes |

The default markup/margin for the cost type. When set, this updates the percentage Markup/Margin for all rows in the estimate with that cost type. Margin is based on the sales price. Markup is calculated based on the cost of the item. |

| Total Sales | Calculated | Yes | Total Sales is equal to the sum of Total Cost x ( 1 + Markup) OR Total Cost / (1 - Margin) for all rows in the estimate for that cost type. |

| Total Profit $ | Calculated | No | Total Profit is equal to Total Sales - Total Cost for each cost type. |

Additional Adjustments

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| (Legacy) Overhead | Calculated | No |

Overhead is equal to Overhead % x Total Sales. |

| (Legacy) Discount | Calculated | No | Discount is equal to (Total Sales + Overhead $) x -Discount %. |

| Custom | - | - | Add Adjustments to an Estimate |

| Total Adjustments | Calculated | Yes | Total Adjustments is equal to Overhead $ + Discount $. |

Taxes

Note

The following are available for each Cost Item type (material, labor, equipment, subcontractor, and travel), defined in your Cost Catalog. See How do Cost Catalog item types relate to cost types in Procore?

These do NOT currently reflect cost types incorporated into budget codes or your work breakdown structure.

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Labor Tax % | Standard | Yes | The percent at which to apply tax to labor. |

| Labor Tax $ | Calculated | No | Labor Tax is equal to (Total Labor Sales + Overhead) x Labor Tax %. |

| Material Tax % | Standard | Yes | The percent at which you want to apply tax to materials. |

| Material Tax $ | Calculated | No | Material Tax is equal to Total Material Sales x Materials Tax %. |

| [Other Taxes] |

Based on what other cost types you have, you will see additional taxes. Other taxes is equal to Total [type] Sales x [type] Tax. |

||

| Total Taxes | Calculated | No | Total Taxes is equal to Labor Tax + Material Tax + [Other Tax]. |

Others

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Bonding | Standard | Yes |

How much insurance percentage you pay based on Total Sales, Adjustments, and Taxes. Bonding is equal to (Total Sales + Total Adjustments + Taxes) x Bonding %. |

| [Custom Adjustments] | Standard | Yes |

Additional adjustments added. The amount is equal to (Total Sales + Total Adjustments+ Taxes) x [Custom Adjustment %]. |

| Total Other | Calculated | No | Total Others is equal to the sum of all adjustment amounts in this section. |

Total

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Total | Calculated | No | The Total Sales Price + Total Adjustments + Total Taxes + Total Other. |

Unit Cost Pricing for Labor

Show/Hide Field Descriptions and Calculations

Estimate Section

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Budget Code | Source | Yes |

A budget code combination of cost code, cost type, sub job, and custom segments, that creates corresponding line items in your budget. Default settings for an item or assembly are configured in your Cost Catalog. |

| Quantity | Source | Yes |

The quantity of the item as calculated in the takeoff. The default quantity is equal to 2D takeoff quantity + 3D takeoff quantity. |

| Unit Cost ($) | Source | Yes |

The cost of a single item. Default cost settings for the item are configured in your Cost Catalog. |

| Waste (%) | Source | Yes |

A percentage of material over the actual estimated quantity. The default setting is set in the Summary Section for Lost Time & Waste. |

| Subtotal Item Cost ($) | Calculated | Yes* |

The subtotal cost of an item's materials, equipment, or other, as determined by the cost item type in the Cost Catalog. Subtotal Item cost is equal to Quantity x (1+ Waste %) x Item Cost. *Total cost can be overridden on Group level. |

| Margin/Markup (%) | Source | Yes |

Your profit margin for the item cost, as a percent for the item. The default setting for Material, Equipment, Subcontractor, Travel Margin/Markup is set as the Markup/Margin % in the Summary Section. Margin is based on the sales price. Markup is calculated based on the cost of the item. |

| Sales Price ($) | Calculated | No |

Sales price is equal to: Total Cost x ( 1 + Markup) |

| Subtotal Item Sales ($) | Calculated | No | Subtotal Item Sales is equal to Sales Price x Quantity. |

| Profit ($) | Calculated | No | Profit is equal to Total Sales - Total Cost. |

| Unit Labor Cost ($) | Source | Yes |

The cost of labor per hour. Default settings for an item or assembly are configured in your Cost Catalog. |

| Total Labor ($) | Calculated | Yes* |

Total Labor is equal to Quantity x Labor Cost. *This can be overridden at the Group level. |

| Labor Margin/Markup (%) | Source | Yes |

Your profit margin/markup for labor. Margin is based on the sales price. Markup is calculated based on the cost of the labor. The default is set in the 'Summary' section of the Estimate. |

| Total Labor Sales ($) | Calculated | No |

Total Labor Sales is equal to Total Labor $ x ( 1 + Labor Markup) |

| Total Cost ($) | Calculated | No |

Total Cost ($) is equal to: Subtotal Item Cost + Total Labor ($) |

| Total Cost / sq ft | Calculated | No |

Total Cost / sq ft is equal to: Total Cost ($) + Project Square Feet (This number is entered in the project Admin tool - Project Information) |

| Total Cost (%) | Calculated | No |

Total Cost (%) is equal to: A percentage of Total Cost ($) over the Total Sales ($). |

| Total Sales ($) | Calculated | No |

Total Sales ($) is equal to: Subtotal Item Sales ($) + Total Labor Sales ($) |

| Notes | Standard | Yes | Notes may be typed into this column for each item. Notes are NOT private and will be visible to other users with permissions to view the estimate. |

| Tax | Source | Yes |

Turn on or off material tax for individual items. All other items are considered taxable. |

Summary Section

Labor and Materials

The following are available for each Cost Item type (material, labor, equipment, subcontractor, and travel), defined in your Cost Catalog. See How do Cost Catalog item types relate to cost types in Procore?

Note: These do NOT currently reflect cost types incorporated into budget codes or your work breakdown structure.

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Lost Time & Waste % | Standard | Yes |

The default percentage per cost type, based on the item type from the Cost Catalog. When set, this updates the percentage Lost Time & Waste for all rows in the estimate with that cost type. |

| Total Cost ($) | Calculated | No | Total Cost is equal to the sum of Cost x Quantity for all rows in the estimate for that cost type. |

| Profit Markup/Margin % | Standard | Yes |

The default markup/margin for the cost type. When set, this updates the percentage Markup/Margin for all rows in the estimate with that cost type. Margin is based on the sales price. Markup is calculated based on the cost of the item. |

| Total Sales | Calculated | Yes | Total Sales is equal to the sum of Total Cost x ( 1 + Markup) OR Total Cost / (1 - Margin) for all rows in the estimate for that cost type. |

| Total Profit $ | Calculated | No | Total Profit is equal to Total Sales - Total Cost for each cost type. |

Additional Adjustments

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| (Legacy) Overhead | Calculated | No |

Overhead is equal to Overhead % x Total Sales. |

| (Legacy) Discount | Calculated | No | Discount is equal to (Total Sales + Overhead $) x -Discount %. |

| Custom | - | - | Add Adjustments to an Estimate |

| Total Adjustments | Calculated | Yes | Total Adjustments is equal to Overhead $ + Discount $. |

Taxes

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Labor Tax % | Standard | Yes | The percent at which to apply tax to labor. |

| Labor Tax $ | Calculated | No | Labor Tax is equal to (Total Labor Sales + Overhead) x Labor Tax %. |

| Material Tax % | Standard | Yes | The percent at which you want to apply tax to materials. |

| Material Tax $ | Calculated | No | Material Tax is equal to Total Material Sales x Materials Tax %. |

| [Other Taxes] |

Based on what other cost types you have, you will see additional taxes. Other taxes is equal to Total [type] Sales x [type] Tax. |

||

| Total Taxes | Calculated | No | Total Taxes is equal to Labor Tax + Material Tax + [Other Tax]. |

Others

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Bonding | Standard | Yes |

How much insurance percentage you pay based on Total Sales, Adjustments, and Taxes. Bonding is equal to (Total Sales + Adjustments + Taxes) x Bonding %. |

| [Custom Adjustments] | Standard | Yes |

Additional adjustments added. The amount is equal to |

| Total Others | Calculated | No | Total Others is equal to the sum of all adjustment amounts in this section. |

Total

| Column Name | Column Type | Override? | Description |

|---|---|---|---|

| Total | Calculated | No | The Total Sales Price + Total Adjustments + Total Taxes + Total Other. |